charitable gift annuity example

They donate 50000 in cash to Hadassah to establish a two-life charitable gift annuity. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation.

Example Of A Flexible Deferred Gift Annuity Whitman College

Charitable Gift Annuities An Example.

. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. Again youll need to calculate the present value of the annuity income. An Example of How It Works Dennis 75 and Mary 73 want to make a contribution to Temple University but they also want to ensure that they have dependable income during their.

Example assumes a 34 percent applicable federal rate AFR and a federal income tax bracket of 35. Charitable Gift Annuities An Example Our donor age 75 plans to donate a maturing 25000 certificate of deposit to AARP Foundation. We understand that you may be interested in a.

For example one regulation governing a charitable gift annuity assumes that the money left over after all payment obligations have been satisfied the residuum should be. Charitable Gift Annuities An Example. Charitable Gift Annuities An Example.

Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. You make an irrevocable gift of cash securities or other property to Georgetown. Charitable Gift Annuities An Example.

Charitable Gift Annuities An Example. In exchange Georgetown pays you a fixed amount each year for the rest of your life. Because they need continuing income they decide.

Based on their ages they will receive a payout rate of 59 percent 2950 each year for life and are. With charitable gift annuities you can generally only exclude the part of the capital gain that went to charity. You have sufficient income now but want to supplement your cash flow later for example when you retire.

Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. State tax liability is not. Charitable Gift Annuities An Example.

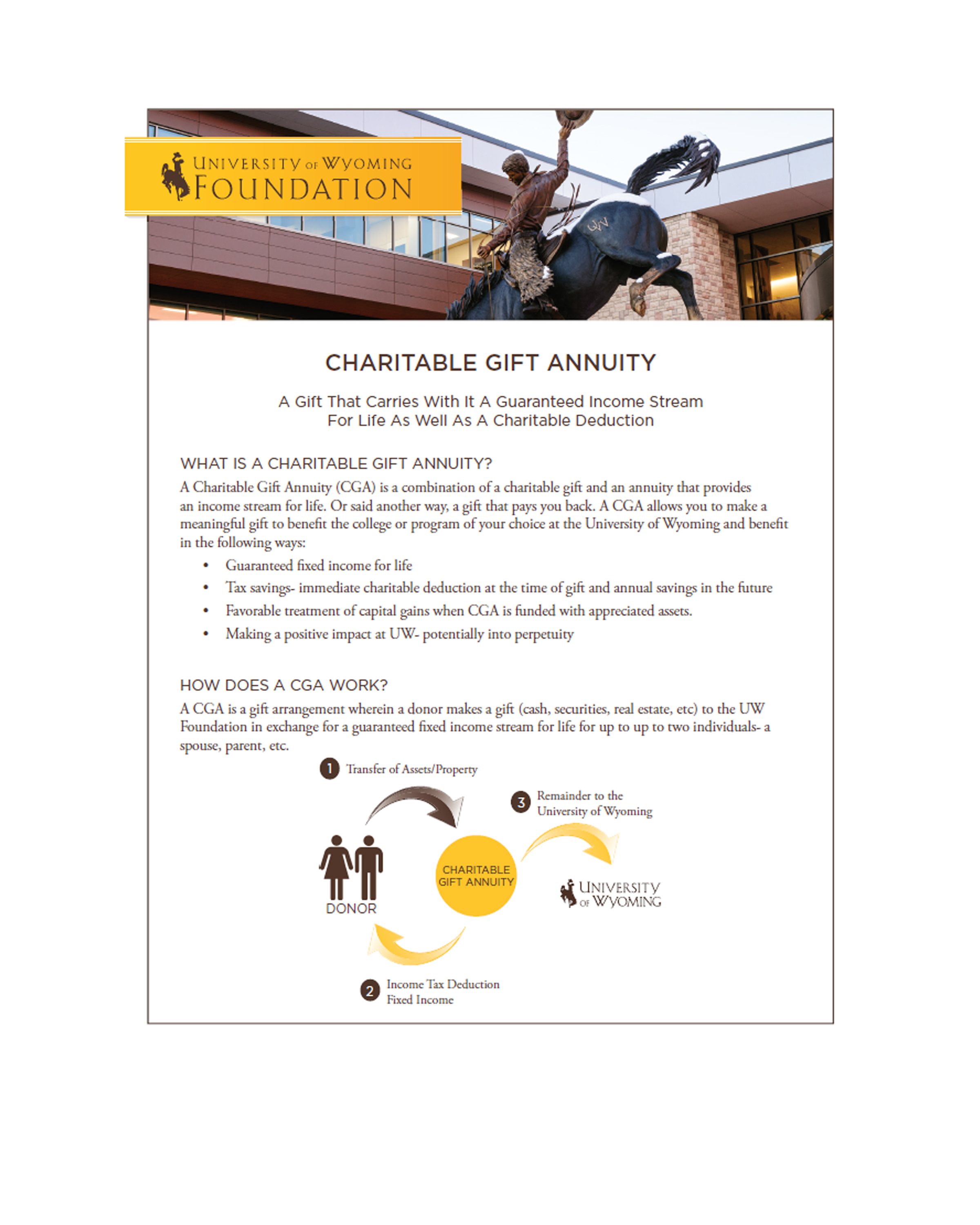

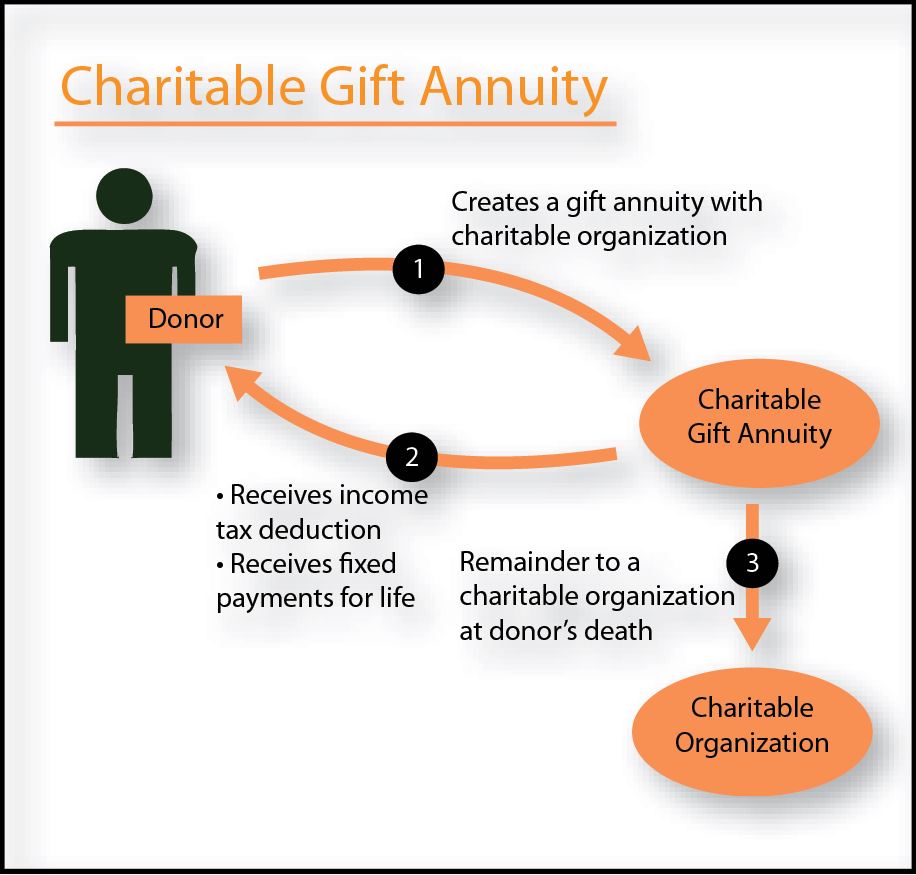

A graphic illustration of a charitable gift annuity is available. A charitable gift annuity example. After Anns death the balance of the invested funds will go to her favorite qualifying charities including a local animal shelter.

Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. The following is a sample disclosure for a charity to consider using based upon advice and guidance from its own legal counsel.

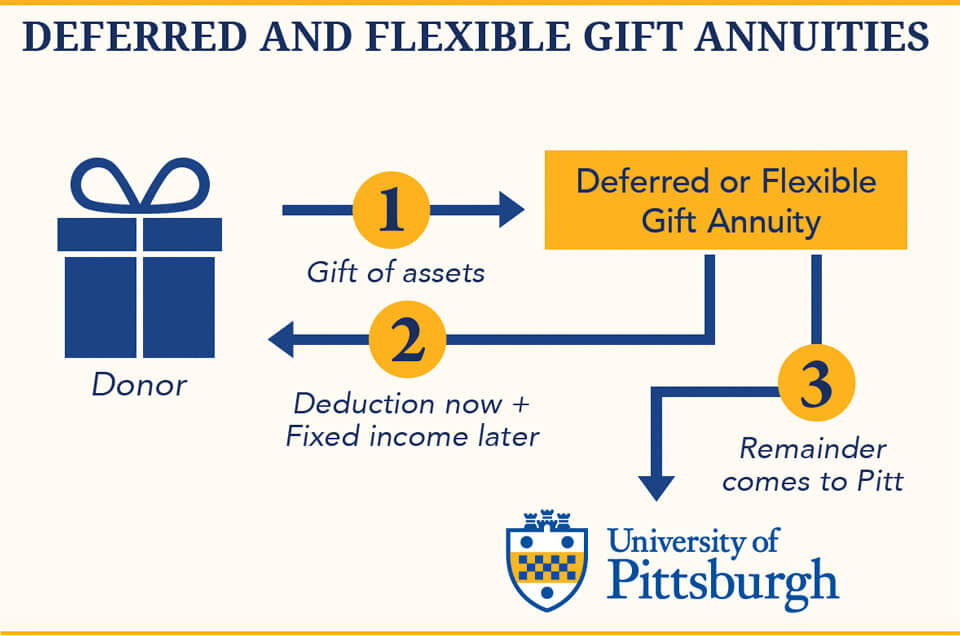

A deferred charitable gift annuity could be right for you if.

Nine Pbs Gift Annuity The Gift That Gives Back

Charitable Gift Annuities The University Of Pittsburgh

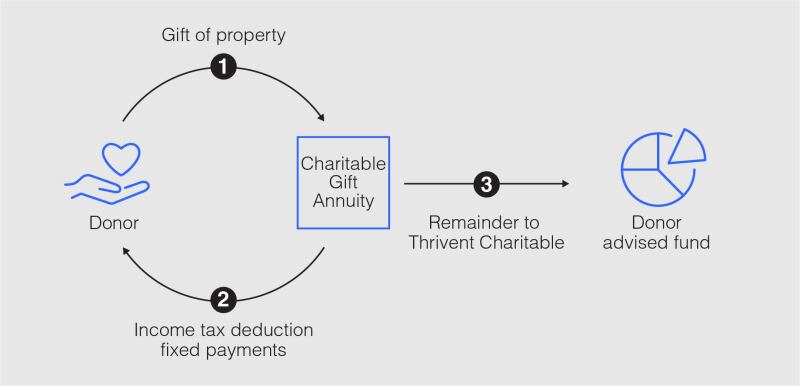

What Is A Charitable Gift Annuity Thrivent

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

Example Of Charitable Non Grantor Lead Annuity Trust Whitman College

9 Taxation Of Charitable Gift Annuities Part 2 Of 4 Planned Giving Design Center

Gift Calculator Planned Parenthood

New Charitable Gift Annuity Option Offers Greater Flexibility

Life Income Plans University Of Maine Foundation

Charitable Gift Annuities Fidelity

Charitable Gifts Archdiocese Of New York

Fy13 Charitable Gift Alzheimer S Association

Charitable Gift Annuities Maryknoll Fathers Brothers

Compelling Stories Market Charitable Gift Annuities Most Effectively

Deferred And Flexible Charitable Gift Annuities American College Of Trust And Estate Counsel Actec Foundation

Charitable Gift Annuities Kqed

Charitable Gift Annuities Preachers Aid Society And Benefit Fund